By Enyeribe Anyanwu

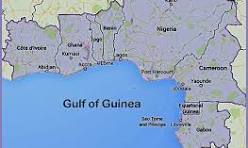

The War Risk Insurance charge imposed on the Gulf of Guinea-bound cargoes by foreign ship owners may not end soon despite the return of relative peace in the region. This is because foreign ship owners trading to Nigeria and other GoG nations are not excited over the return of peace in the region. They have refused to acknowledge the absence of piracy incidents in the region for the past three and half years.

Not acknowledging the improved security situation in the Gulf of Guinea, they still come with private security guards, even though this is against Nigerian laws. Paying private security guards provides them the justification for the sustenance of WRI on the GoG nations.

As the saying goes, no one would like to change a situation one is benefitting from. This is the case with foreign ship owners who reap from the extra charges on Nigerian bound cargoes –a situation reminiscent of the Cement Armada of the early 70s.

Nigerian shippers pay an estimated $500m dollars annually in War Risk Insurance, amounting to a whopping $1.5billion in the last three years. The insurance premium comprises two components: War Risk Liability which covers people and goods aboard vessels, and War Risk Hull covering the vessel itself which is determined by its value. A single Very Large Crude Carrier (VLCC) is said to incur up to $445,000 in surcharges per voyage. New container vessels pay up to $525,000. Worse still, shipping lines like Maersk impose additional transit disruption charges of $450 per container.

All these are enormous costs that are passed on to Nigerian importers in form of increased shipping costs, which are in turn passed to the consumers. The WRI insurance requirements also impact on Nigeria’s economic activities as it affects trade volumes and shipping routes.

For years, there was good justification for WRI on Nigerian-bound cargoes because of the real threat of piracy and the Niger Delta militancy. But this has been contained, with no reported cases of ugly incidents in the region in recent years. This was confirmed by the International Maritime Bureau (IMB) in 2021, as Nigeria was officially removed from the list of piracy-prone countries.

The International Bargaining Forum (IBF) further validated this progress in 2023, delisting Nigeria from high-risk maritime nations.

Nigeria’s Minister of Marine and Blue Economy, Adegboyola Oyetola, has also repeatedly affirmed that there hasn’t been a single pirate incident in Nigerian waters for over three years, attributing this peace to the multi-billion naira Deep Blue Project spearheaded by NIMASA.

Apart from the Deep Blue Project, there has been enhanced international cooperation and coordination among regional and national authorities. The presence of regional and international naval assets have also contributed immensely.

The combination of all these efforts have led to the significant decrease in piracy incidents and kidnapping in the region. Despite all this, foreign shipping companies have refused to acknowledge the result of all these efforts which will lead to removal of War Risk Insurance in the Gulf of Guinea. They still bandy the existence of threats in the region to the foreign insurance firms—most notably Lloyd’s of London and various Protection & Indemnity (P&I) clubs, that still classify Nigerian waters and GoG nations as high-risk.

Confronting WRI Frontally

In response to the anguish and outcry of Nigeria shippers, the Maritime Reporters Association of Nigeria (MARAN), the foremost group of maritime journalists in Nigeria, have vowed to fight this economic drain to a standstill. This, the group says, has become necessary as the diplomatic and other efforts by the Nigerian Maritime Administration and Safety Agency (NIMASA) to change the narrative appear not be yielding any result.

This is more so as maritime stakeholders are demanding more aggressive and sincere action towards ending the exorbitant and unjustifiable war risk charges on consignments coming to Nigeria. The stakeholders question why Nigeria with confirmed secure waters should continue to be treated as a war zone by international shipping community.

To confront the problem frontally, MARAN decided to make the issue the subject of its 3rd Annual Lecture (MAMAL 2025). The association intends to expose the evil and fraud in the war risk premium paid by Nigerian importers.

With the theme, “Addressing the Burden of War Risk Insurance on Nigerian Maritime Trade”, the 2025 annual lecture aims to present a rallying cry to the federal government and all stakeholders to acknowledge the severe economic impact of the WRI charges, with the view to tackling it headlong.

MARAN believes that the persistent drain on the Nigerian economy and increase of cost of goods caused by payment of WRI is an international affront that demands immediate and decisive action, hence, it is taking steps to push the government and stakeholders into collaboration to end the economic hemorrhage.

Said the President of the association, Mr. Godfrey Bivbere, WRI is a fraud burdening the economy of Nigeria and the developing countries in the Gulf of Guinea, declaring that MAMAL 2025 will dissect every facet of the issue, from the perceived threats to the profound implications of persistent Extra War Risk Insurance (EWRI).

“It will scrutinize the roles of classification societies like Lloyd’s of London and critically examine the contributions of core stakeholders, including NIMASA, the Nigerian Navy, and other maritime and security operators.”

“Crucially, MAMAL 2025 will draw over 500 key stakeholders, including maritime security experts, ship owners, terminal operators, international shipping lines, diplomats, insurers, regulators, and legal experts,” he said, adding that the forum offers a genuine opportunity for a united front against this exploitative practice.

More Stories

The Renewed Battle Over National Coast Guard

Unfolding Positive Developments at NPA

AFMESI: Rallying African coastal communities against climate change